All Categories

Featured

Table of Contents

[/image][=video]

[/video]

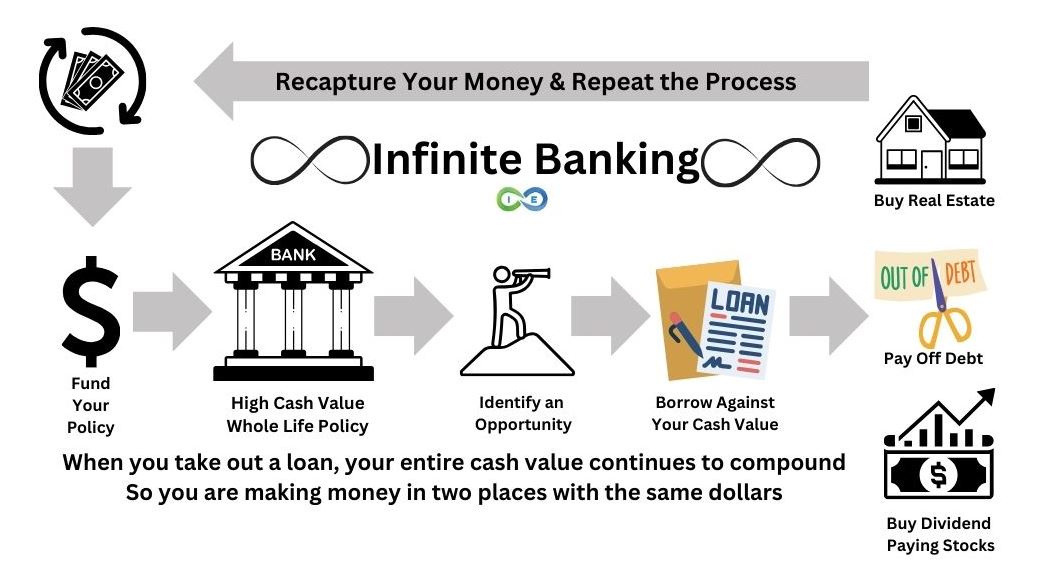

The more you place right into it, the extra you venture out. Overfunding brings about greater cash money worths and rewards, transforming your policy into an effective monetary device. Overfunding your policy is just another way of stating the objective needs to be to make best use of cash and lessen costs. You need to know. If you pick a common insurance provider, the money will certainly have an assured rate of return, but the guaranteed price will certainly not suffice to both support the irreversible coverage permanently AND produce a consistent policy car loan.

This does not imply the strategy can not work. It simply suggests it will certainly not be ensured to work. Assurances are costly, risk is cost-free. You life insurance coverage money growth in a common life insurance policy firm will certainly be proclaimed annually, is subject to alter, and has balanced between 3.5-5.5% after costs.

Any kind of properly developed policy will certainly include using compensated enhancements and could also assimilate some non commissionable insurance policy to further decrease thew charges. We will certainly chat extra concerning PUA cyclists later, however recognize that an extensive conversation in this tool is impossible. To dive much deeper on PUA riders and various other means to lower charges will require a comprehensive one on one conversation.

You're regarding to open the power of leveraging equity from this individual bank. Borrow against your cash money surrender worth. The appeal here exists in the flexibility it offers you can make primary and rate of interest repayments on any type of schedule preferred or pay absolutely nothing until able to make a balloon repayment.

What Is Infinite Banking

Having the capability to manage when and just how one repays a funding is very useful, making it possible for higher adaptability than conventional finances supply. Entire life insurance policy policies, unlike traditional loans, permit unbelievably versatile settlement routines. The purpose here is not just to utilize but likewise manage this property successfully while appreciating its advantages.

Unlike term plans that offer insurance coverage only for collection durations, cash-value policies are here to stay. One of the most significant benefits of a cash-value policy is the tax-free development within permanent policies.

By leveraging PUA bikers successfully, you can not only enhance your policy's cash value but additionally its future dividend potential. If you're interested in including PUAs to your policy, merely reach out to us.

The costs aren't precisely pocket modification, and there are prospective liquidity dangers involved with this method. I'll simply go ahead and excuse half the area currently.

How To Use Whole Life Insurance As A Bank

This is regarding setting realistic financial goals and making notified decisions based on those objectives. If done right, you could produce a different financial system using whole life insurance policies from mutual insurance firms using long-lasting protection at low-interest rates contrasted to conventional lenders.

401(k)s, Individual retirement accounts, and various other retired life accounts use tax obligation benefits and long-term growth capacity. High-income income earners can become their very own financial institution and generate significant cash circulation with irreversible life insurance policy and the limitless banking method.

For more details on the unlimited financial strategy, begin a conversation with us right here:.

Infinite Banking Book

Attempt to end up being extraordinary. If you are struggling financially, or are fretted concerning how you could retire one day, I believe you might discover some of my over 100 FREE useful.

If you need a that you can actually sink your teeth into and you are willing to extend your comfort area, you have actually come to the right location. It's YOUR money.

Become Your Own Bank Whole Life Insurance

Sadly, that funding versus their life insurance policy at a greater rates of interest is mosting likely to set you back more cash than if they hadn't transferred the debt in all. If you want to utilize the method of becoming your very own lender to expand your wealth, it is necessary to understand just how the technique truly functions before borrowing from your life insurance policy plan.

And by the means, whenever you borrow cash always see to it that you can make more cash than what you have to spend for the financing, and if you ca n'tdon't obtain the cash. Making certain you can gain even more cash than what you have actually obtained is called producing complimentary capital.

Complimentary money flow is much more crucial to developing wide range than buying all the life insurance policy worldwide. If you have inquiries regarding the validity of that statement, research study Jeff Bezos, the creator of Amazon, and figure out why he believes so highly in cost-free capital. That being said, never ever undervalue the power of owning and leveraging high cash value life insurance to become your very own banker.

Discover The Perpetual Wide Range Code, an easy system to make the most of the control of your financial savings and minimize fines so you can keep more of the cash you make and develop wealth yearly WITHOUT riding the marketplace roller-coaster. Download and install below > Instance: "I think it's the most intelligent method to collaborate with money.

Many people are shedding cash with common financial planning. Also individuals that were "set for life" are running out of money in retired life.

Becoming Your Own Banker Explained - Round Table

Tom McFie is the creator of McFie Insurance which helps individuals keep even more of the cash they make, so they can have economic tranquility of mind. His newest book,, can be acquired right here. .

They are paying you 0.5% rate of interest per year which makes $50 per year. And is taxed at 28%, leaving you with $36.00 You choose to take a financing for a new used auto, instead than paying money, you take a financing from the financial institution: The funding is for $10,000 at 8% interest paid back in one year.

at the end of the year the interest expense you $438.61 with a payment of 869.88 for year. The Bank's Profit: the distinction between the 438.61 and the $36.00 they paid you is $402.61. In other words, they are making 11 times or 1100% from you all while never ever having any of their money while doing so.

Like become the proprietor of the device the financial institution. Allow's remember that they don't have actually any type of money invested in this formula. They simply loaned your cash back to you at a greater rate.

Life Without The Bank & Becoming Your Own Banker

If you obtain you pay passion, if you pay cash you are quiting rate of interest you might have earned. Regardless you are quiting interest or the potential to get interestUnless you have the banking function in your life. You get to maintain the automobile, and the principle and rate of interest.

Think of never having to stress concerning financial institution loans or high interest rates once again. What if you could borrow money on your terms and develop wide range simultaneously?

Table of Contents

Latest Posts

Infinite Banking

How To Be My Own Bank

Becoming Your Own Banker

More

Latest Posts

Infinite Banking

How To Be My Own Bank

Becoming Your Own Banker